Yes, I am riffing Chasing Homer by Laszlo Krasznahorkai:

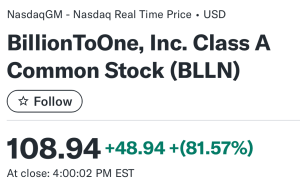

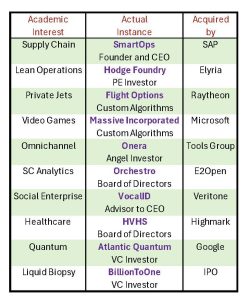

So BLLN is the ticker symbol of BillionToOne, a Neotribe investment, which filed its S1 last month, that had its IPO today (Rings the Opening Bell), and as you many of know, or may not know, I don’t know why I even said this, from Holy Grail of Holy Grail, I fell in love with Liquid Biopsy–can blood really whisper secrets of the future?– pretty much the first time I came across it, and how curious that, as I started to work on Liquid Biopsy, with my PhD student Kyra Gan, and Su Jia and Andrew Li, me just out of curiosity, that, at the same time, Kittu Kolluri, my IIT-Madras classmate, founder of Neotribe VC, where I am a Limited Partner and Advisor, was evaluating (and we soon invested in) BillionToOne (whose CEO and co-founder, Oguzhan Atay, is a PhD from Stanford), a startup to commercialize Liquid Biopsy, thus putting my money where my math is, and now, in 2025, our Management Science paper on Liquid Biopsy, that won the Pierskalla Prize – my second, the first being on OrganJet, see À la recherche de moins de temps, also published in Management Science – appeared online and BillionToOne had its IPO, both of these initiatives showcasing my expression of care, as I explained in The Importance of Being Caring, and as if curiosity and commercialization have signed a covenant, this year, additionally, our IJOC Quantum paper appeared and Google acquired Atlantic Quantum (another Neotribe investment, with CEO and co-founder, Bharath Kannan, a PhD from MIT), suggesting perhaps that physics, biology, operations research, machine learning, computer science, operations management, university research, entrepreneurship and venture capital may be entangled!

This is the timeline and steps to IPO:

Congratulations to BillionToOne for the exquisite execution – a delectable Turkish Delight – en route to even greater things! (Here is an excellent Forbes writeup.) Here is the essential arithmetic of Neotribe investment:

I want to savor this occasion, where my academic interests and capitalist outcomes have again successfully fused – Academic Capitalism indeed – as in several previous ones:

As I wrote in An Essay on Operations Management (2017):

I readily admit that I did not, at the outset, plan for (or envision the possibility of) such a fulfilling experience. Being ignorant of how the world actually works and the many urgent needs of our society, my preoccupations then were largely confined to mathematical analysis of make-believe models. I grew beyond this stage of intellectual immaturity (less rapidly than I would have liked) as I recognized that (1) OM could be a channel for something of great value, (2) technique without application is barren, (3) to know what problem to study is quite as important as (if not more than) developing the solution to it, and (4) a prelude to the analytical intellect is a part of mind where imagination resides, and one should allow the intellect to lie fallow. (Perhaps imagination is more important than knowledge!) I took the road less traveled—which has indeed made all the difference—by putting the intimate fusion of theory with practice at the center of my scheme, by participating in the new forces (such as information technology, globalization, and venture capital (VC)-infused software entrepreneurship) that have made our world so different, and by distancing myself, repeatedly, from the mechanical imitations of inherited habits in favor of pursuing newness.

It is in the belief that many colleagues who wish to make an impact on practice—who hope that their final harvest will not just be a sheaf of mathematical formulae—could benefit from my experience and observations that I have written this essay, offering examples that depart from the mainstream, encouraging them to forge their own path. I hope that my cheerful insouciance—an untainted and joyous celebration of our kaleidoscopic choices—while hopping seamlessly from frivolous video games to lifesaving organ transplants, has not concealed my conviction that OM can be a channel for creating significant value in our society while retaining the aesthetic sensibilities that we academics value so much.

Some of you have asked what books may have influenced my worldview. Here are a few related to Getting Buy-in, Creativity, Scientific Entrepreneurship, The Nature of Technology, Innovation driven Prosperity (highly recommend Schumpeter’s Market by David Reisman and both Lever of Riches and The Gifts of Athena by Joel Mokyr) and Capitalism: